- A massive $1.4B hack of Bybit drained funds that were mainly made up of ETH along with stETH, cmETH, and mETH and transferred them to Lazarus Group linked actors.

- Major crypto exchanges along with whales allocated more than $390 million worth of loans together with deposits to let Bybit sustain customer withdrawals.

- Operating as a fund launderer the attacker executes transfers between numerous wallets through OTC trading of stolen funds.

Introduction:

A theft occurred at Bybit cryptocurrency exchange when hackers stole $1.4 billion worth of Ethereum (ETH) and additional digital assets. In an initial public disclosure of the hack blockchain investigator @zachxbt explained that Bybit lost ETH alongside stETH together with cmETH and mETH assets. The hack caused an immediate uproar in the crypto industry because security issues emerged while experts suspected involvement from the notorious Lazarus Group.

The Bybit Hack: Breakdown of Stolen Funds

The executed hack resulted in a tremendous loss of $1.4 billion in Bybit assets, including various Ethereum-based tokens. Đetectors tracing the hacker affiliated with these addresses.

0x47666fab8bd0ac7003bce3f5c3585383f09486e2Database analysis indicates that the involved hacker continues to transform stolen stETH along with cmETH and mETH into ETH before attempting to clean the stolen assets through market transactions.

Bybit’s Reserves and the Impact of the Hack

The exchanges reserve assets disclosed $16.2 billion to CoinMarketCap before the security breach happened. A total of $1.4 billion dollars was stolen from Bybit which equated to 8.64% of their total holdings leading to detrimental financial effects for the exchange. Bybit executed quick countermeasures to protect withdrawal functions while facing an extensive asset depletion.

Emergency Fund Transfers and Loans to Bybit

Major crypto entities along with whales have provided Bybit with liquidity support after the attack took place. Notable transactions include:

- The entity Bitget under the handle @bitgetglobal extended a financing transaction totalling 40,000 ETH which amounted to $106M to Bybit.

- An institution funded Bybit with 11,800 ETH worth $31M through a loan deposited into its cold wallet.

- Bybit obtained 36,000 ETH worth $96.5 million through a Binance hot wallet transfer to their cold wallet facility.

- Bybit has become the beneficiary of 145,879 ETH equivalent to $390M through both deposits and loans since the security breach.

Additional notable transfers:

- MEXC transferred 12,652 stETH ($33.74M) to Bybit.

- The wallet of Fenbushi Capital made a deposit consisting of 10,000 ETH amounting to $27 million into Bybit.

- The exchange entity DWF Labs (@DWFLabs) contributed 2,200 Ethereum tokens worth $6.02 million to Bybit.

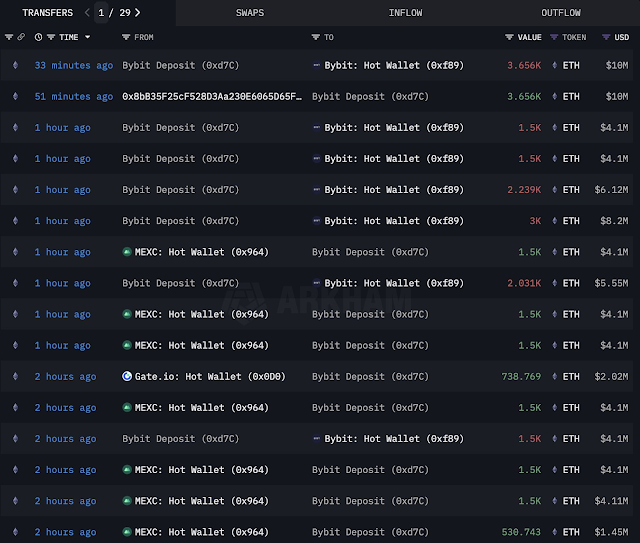

- The financial entity Whale "0xd7CF" acquired 15,427 ETH having a worth of $42.2 million from Centralized exchanges and Decentralized exchanges before making a transaction to Bybit.

Operation stability and processing of user withdrawals are maintained by these emergency fund transfers during the breach.

Hacker’s Current Holdings and Laundering Efforts

The hacker currently maintains possession of 489,395 ETH worth $1.32 billion as well as 15,000 cmETH that stays locked and non-withdrawable. The hacker engaged in wallet transactions by sending 10,000 ETH ($27M) to "Bybit Exploiter 54" after starting the fund laundering process through several account addresses.

Bybit’s Response and Countermeasures

The financial consequences of the hack seem to have prompted Bybit to make direct Ethereum transactions through an over-the-counter (OTC) method. According to available reports Bybit made OTC purchases by spending $100M USDT to acquire 36,893 ETH from both Galaxy Digital and FalconX at a rate of $2,711 each. Bybit purchased 71,755 ETH worth $197M from OTC deals to build up its reserves and strengthen its liquidity position.

What’s Next for Bybit?

The Bybit hack has raised serious concerns about security protocols within centralized exchanges. Bybit has obtained emergency funding to operate but must implement extra protective measures so that users remain convinced about their platform security.

Several key questions remain:

- Does Bybit hold any possibility for retrieving the hacked funds? Blockchain forensics together with law enforcement investigations enhance the possibility that investigators can track down and freeze some of the stolen funds.

- How will Bybit reinforce security? The exchange requires extra security measures to safeguard against future incidents by potentially getting blockchain security firms to assess and upgrade its systems.

- The current incident will it damage Bybit's standing for an extended period? To preserve trust within the crypto sector the exchange needs sustained user transparency and support as it has successfully managed the current crisis.

Conclusion

The $1.4 billion Bybit hack remains one of the biggest security breaches ever recorded in cryptocurrency exchange history because it demonstrates constant dangers in the crypto industry. The Bybit hack demonstrates why strong security systems and quick crisis management become essential after evidence reveals Lazarus Group membership as well as Binance association and substantial fund transfers during the incident. Bybit accomplishes securing emergency funds but the exchange now needs to rebuild its security framework through a process of rebuilding user trust. The next few weeks will define the lasting effects which this attack will impose on Bybit and the entire cryptocurrency market.

0 Comments