- Ethena (ENA) faces the largest and riskiest unlock, releasing $833.73M (66.19% of its circulating supply). This could trigger significant selling pressure, given only 21.2% of its total supply was previously unlocked.

- Established tokens like SUI, KAS, and IOTA have already unlocked substantial portions of their supplies (31%, 89.2%, and 73.8%, respectively), reducing dilution risks. Their price movements are more likely to follow broader market trends than unlocks.

- BERA (9.27% unlock in 60 days) and MOVE (2.08% unlock in 70 days) offer time to assess project developments and community sentiment. Their distant unlock dates allow strategic positioning based on fundamentals.

Token unlocks starting from March 3 until March 9 will affect cryptocurrency markets.

The cryptocurrency market anticipates multiple token unlocks starting from March 3 to March 9, 2024. Artificial token unlocks cause market volatility because they change the supply-demand relationships within the network. Eight crypto projects which include SUI, IOTA, EIGEN, ENA, KAS, MOCA, BERA, and MOVE will let free their tokens for circulation from March 3 through 9 which could affect investor sentiment as well as cryptocurrency markets. This section provides an analysis of each upcoming unlock situation while evaluating market reaction potential.

Understanding Token Unlocks

Project teams and investors receive allocated tokens through the process called token unlocks at predetermined times. These events expand circulating supply and may produce selling pressure through recipient selling activities. Price falls do not always occur during unlocks since projects that maintain proper management employ strategic incentive or vesting strategies to reduce risk exposure. Key metrics to watch include:

- The dollar amount of tokens which go into circulation represents the unlock value.

- High dilution risks occur with larger percentages of circulating supply.

- Lock-up expiration dates relative to the present time often prompt investors to trade before or after the release events.

The following breakdown details the upcoming token releases during the next week.

1. SUI (Sui Network)

Current Price: $2.89 | 24h Change: +1.77%

Market Cap: $9.12B | Circulating Supply: 3.17B

Unlock Details:

Value: $117.41M (1.28% of supply)

Total Unlocked: 31.0%

Time: 00 days, 13 hours remaining

READ MORE: Ripple Labs Partners with BDACS to Expand Crypto Custody in South KoreaAnalysis:

SUI blockchain is about to release $117.41M worth of tokens as it operates as a Layer-1 blockchain dedicated to fast transactions. Although the precise hint of unlocked tokens represents 1.28% of supply it could hold significant market worth that might capture investor notice. SUI maintains consistent market stability during token unlocks since 31% of its supply has already become accessible to the market. Market participants seem hesitant to enter positions because of the large unlock amount.

2. IOTA (IOTA)

Current Price: $0.210 | 24h Change: +3.96%

Market Cap: $771.14M | Circulating Supply: 3.65B

Unlock Details:

Value: $1.82M (0.24% of supply)

Total Unlocked: 73.8%

Time: 1 days, 13 hours remaining

Analysis:

The unlock event of IOTA yields a small $1.82M value while its circulating supply of 0.24%. The liquid state of the IOTA ecosystem improves because more than 74% of the total supply has already reached full availability. Past price growth of 3.96% shows bullish indicators which might overshadow the concerns about pending unlocks.

3. EIGEN (EigenLayer)

Current Price: $1.62 | 24h Change: 0.00%

Market Cap: $394.34M | Circulating Supply: 244.49M

Unlock Details:

Value: $209M (0.53% of supply)

Time: 2 days, 8 hours remaining

Analysis:

A $209M unlock schedule is set to occur for the restaking protocol EIGEN. Though valued at $209M the actual amount of circulating tokens undergoing unlock stands at just 0.53% of its total supply. EIGEN exhibits sensitivity to volatile market conditions because it holds only 244.49M tokens. EIGEN maintains a fixed price because its market has shown zero change during the previous day. Investors need to check if the unlocking phase matches either future incentives for ecosystem development or early investor disinvestments.

4. ENA (Ethena)

Current Price: $0.403 | 24h Change: -1.23%

Market Cap: $1.26B | Circulating Supply: 3.13B

Unlock Details:

Value: $833.73M (66.19% of supply)

Total Unlocked: 21.2%

Time: 2 days, 20 hours remaining

Analysis:

The ENA unlock represents the critical currency movement during this calendar week. The upcoming market release will load 66.19% of existent circulating supply ($833.73M) into the market. ENA's price decreased 1.23% since investors expressed pre-unlock concerns. The upcoming token release will undeniably cause increased selling pressure due to low previous token unlocking at 21.2%. Unlock packages exceeding 66% of supply tend to cause major price corrections if there are no counteracting demand forces or staking protocols in place.

5. KAS (Kaspa)

Current Price: $0.079 | 24h Change: +0.35%

Market Cap: $204B | Circulating Supply: 25.79B

Unlock Details:

Value: $1.285B (0.63% of supply)

Total Unlocked: 89.2%

Time: 4 days, 13 hours remaining

Analysis:

This sizable unlock worth $1.285B spans a tiny 0.63204B percentage of the total supply while its measured distribution timeline should reduce market volatility. The token’s slight uptick (+0.35%) hints at stable investor confidence.

6. MOCA (Mocaverse)

Current Price: $0.120 | 24h Change: -0.18%

Market Cap: $229.31M | Circulating Supply: 1.91B

Unlock Details:

Value: $291.50K (0.13% of supply)

Total Unlocked: 30.6%

Time: 4 days, 13 hours remaining

Analysis:

The MOCA unlock features a tiny economic impact as it involves $291.5K value and 0.13% of total supply. Market participants display limited interest through the token’s minimal price decrease of -0.18%. Due to its 30.6% unlocked supply and developing network MOCA will not likely affect major market developments.

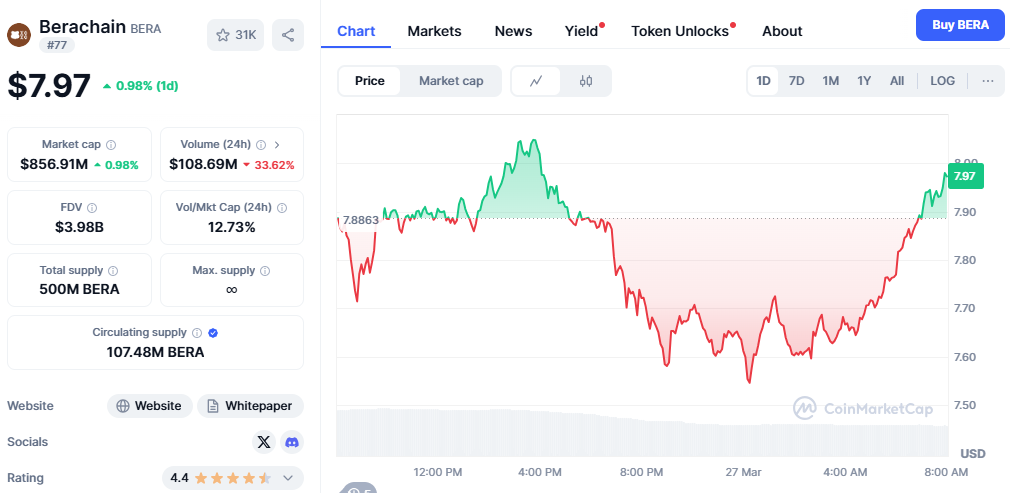

7. BERA (Berachain)

Current Price: $8.47 | 24h Change: +0.72%

Market Cap: $903.20M | Circulating Supply: 107.83M

Unlock Details:

Value: $84.70M (9.27% of supply)

Time: 6 days, 2 hours remaining

Analysis:

The BERA unlock event containing $84.7M represents a 9.27% market supply that creates average dilution risks for investors. The project maintains low circulating supply (107.83M) along with recent price enhancement (+0.72%) which reflects buoyant holder enthusiasm. The unlock amount's relationship to its market capitalization represents a potential challenge to future buyers due to increased risk for early backers who may choose to withdraw their investments.

8. MOVE (Movement)

Current Price: $0.449 | 24h Change: +2.68%

Market Cap: $1.07B | Circulating Supply: 2.40B

Unlock Details:

Value: $22.43M (2.08% of supply)

Total Unlocked: 23.5%

Time: 7 days, 1 hour remaining

Analysis:

The $22.43M MOVE unlock event contributing to 2.08% of supply led to a market price increase of 2.68%. The project exists in its initial development phase with 23.5% of its supply released to the public. The unlock will occur in 70 days from now which allows the team to synchronize their software updates with market expansion thus reducing any adverse effects.

Key Takeaways and Strategies

The 66.19% unlock from ENA represents the highest-risk event during this week. Before significant price movements occur traders should monitor project progress to prevent sell-offs.

SUI together with KAS and IOTA uphold stable market performance because their existing supplies are considerable which minimizes unlock-based risks in the market. The price movements of these projects mainly respond to market-wide influences.

BERA and MOVE present long-term unlock dates that create opportunities to study their community reception as well as basic project analysis.

Conclusion

Token unlocks present both positive and negative effects to the market by demonstrating development funding while becoming source of sell-offs when owners dump their tokens. The upcoming unlock events require investors to undertake thorough research about project layouts and market developments and the extent of token releases available in each platform. The established projects SUI and KAS are expected to tolerate their upcoming unlocks without major hiccups while ENA and BERA experience escalated risks. Knowledge retention alongside portfolio expansion should be your focus as the upcoming week will be volatile.

0 Comments